Chronic student loans are a financial epidemic.

With the weight of student loans carried by the majority of young professionals in their twenties and thirties, student loans have become a national issue. Financial health and literacy have taken center stage as the ramifications of long-term debt begin to delay life’s major milestones for Millennials.

The nation’s student loan balance has ballooned to $1.3 Trillion, up from $447 Billion only ten years ago. This explosion in growth has led to the average student loan debt balance reaching a historic high. With student loan growth outpacing inflation by 6 percent it leaves many families struggling to keep up. Unfortunately, this surge shows no sign of slowing down.

So, what are young professionals to do?

Well, if you have student loans is it time to take some serious action. You don’t want the weight of a costly formal education stymieing the dreams you once set out to achieve – starting your own business, working for a non-profit, or creating the next great work of art. You need to put your intellectual capital to work and be savvy about paying back your student loans.

As a highly educated individual, with an Associates, Bachelors, Masters, Doctorate (or whatever degree you earned), you should be S.M.A.R.T about paying back your student loans. By following the steps listed below, you will be able to pay off your student loans insanely fast and win back your financial future.

Step 1. Small Balances First

Student loans can be daunting to pay off. Their sheer size tends to overwhelm most people. Do not let their size intimidate you because acting like your student loans do not exist is a practice of self-denial. Self-preservation calls for you to address the problem.

By not paying off student loans quickly, the overall cost of your loans can dramatically increase over time as interest begins to accumulate. This means, paying off a growing student loan balance will take more of your hard-earned money out of your pocket. We want to avoid this!

To optimize your behavior when it comes to paying off your loans you need to harness the power of behavioral modification. Researchers at Northwestern University Kellogg’s School of Business have found that by paying off the smallest loan first, people are able to snowball their success. Creating these small wins during the debt repayment process means that people are more likely to pay off all of their debt in full.

It may seem counterintuitive, but ignore your larger loans for now; you will keep them at bay while you focus on eliminating your smallest loan first. This will give you the momentum you need to get rid of your student loans once and for all.

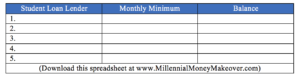

Fill in the below chart with all of your student loans in ascending order (the smallest balance first).

Now that you have listed out your loans, you can hone in on paying off the smallest loan.

Step 2. Pay More than the Minimum

Now that you have zeroed in on your smallest loan, you need to ensure that you are paying more than the monthly minimum every month! Muster all of your resources to ensure that more than the monthly minimum is paid in full. Look underneath the couch for change, sell your extra clothes, or forgo a night out with friends. Do whatever it takes to pay more than the minimum.

Now that you are zeroed in on paying off your smallest loan first, what do you do about your other loans? Because most of your monthly cash flow will be concentrated on paying off your smallest loan, you still can’t lose sight of your other larger loans (if you have any). For those loans, keep paying the monthly minimum to make sure they don’t balloon out of control. By paying the monthly minimum, you can effectively keep them in check.

Step 3. Always Find More Money

It is time to unleash your inner entrepreneur. You need to find a way to do two things in your financial life: 1) Cut expenses and 2) Increase your income. Having exhausted the ways to cut your expenses, you should start focusing on how to increase your income. This is where your entrepreneurial spirit comes in. There are countless ways to earn extra money in today’s shared economy, and with your intelligence and education, you will be able to find something immediately. All you have to do it start looking in the right places.

You can increase your income by extracting value from assets you already own. Whether it is using Airbnb to rent your apartment, lending your intellectual capital by tutoring, starting a blog, or driving for Uber or Lyft, the shared economy is here to help. Take an inventory of your skillsets and put together a strategy to earn some extra dough. Once you start earning this extra money, throw it at your student loans and watch them melt away.

Step 4. Reward Yourself

Celebrating your wins is a vital part of creating new habits. Each time you achieve a major milestone and pay off a student loan, you need to reward yourself. Yes, you have permission to splurge a little bit. When it comes to paying off your student loans, you will be forgoing many things that you would otherwise be spending your money on – clothes, vacations, or nights out.

It is imperative to long-term success to develop a ritual when you pay off a student loan. Whether that is having friends over for dinner, dining at your favorite restaurant, or popping a bottle of champagne, the more cadenced you make your reward, the better.

Step 5. Develop Your Debt Free Timeline

Now that you have all of your student loans listed out, you should have a clear view of your minimum monthly payments. Build a Flash Budget by analyzing your income and expenses over the next several months. Decide how much you can put towards your student loans (stay aggressive here).

Once you have calculated how much you can put toward your monthly payments, it is time to determine how long it will take for you to repay your student loans. Will it take you three months, twelve months, or twenty-four months? After you know your date, mark it on your calendar and place it somewhere prominent. This is your debt-free date – internalize it!

While paying off your student loans the S.M.A.R.T way, it is essential to embrace the process. After graduation, many people sulk about their student loans. Once they begin working full-time, the weight of their student loan payments seems like an anchor. Don’t let that be you. Your student loans are not an anchor. It is important to remain grateful and confident about all that you learned while in school. Realize that paying off your student loans quickly is a temporary discomfort for a lifetime of knowledge.

Because you are taking the time to decide to eliminate your student loans quickly – not waiting five, ten, or fifteen years – you will be ahead of your peers. After you have paid off your student loans entirely, pay it forward and help as many people as possible eliminate student loans from there life too.

Life is a continuous journey, and you will find so too is your education.

PS: #FinHealthMatters to me because understanding your money and financial health lets you live your best life. At Millennial Money Makeover, we want you to live a rich life, which starts with you taking command of your finances. By eliminating your student loans, you can move forward and start doing more of the things you love!

As always, thanks for reading! Happy #FinHealthMatters Day!

Conor Richardson, CPA

#MillennialMoneyMakover