The United States is an incredibly diverse country – economically, socially, and geographically. Have you been using the latter to your advantage? The new rich have.

In the world of personal finance, pundits always search for innovative ideas to help Millennials manage their money. The problem is that they repeat the same unoriginal advice over and over again, like my favorite proverbial cliché: give up your Starbucks cappuccino as a means of saving money.

To escape this blasé advice, you should look at what a silent crop of millionaires is doing. We know investing is a slow drip. But this one thing is adding mounds of cash to their net worth. What is even better about this cohort? They are not changing their lifestyle, just their location. By harnessing the power of geographic arbitrage, they are hacking the differences between economies. You can do the same.

Geographic Arbitrage

Geographic arbitrage is the concept of taking advantage of a price difference between two or more locations. This theory calls for you to analyze the difference in the economic benefits of one geographic area over another due to the cost of living, the purchasing power of your salary, and other factors. There is a very tangible difference between living in say New York or Texas (my favorite example because of its tested assumptions), and you can use this to your financial advantage. Let’s take a closer look.

Scenario Analysis

To give you an idea of what I am referring to, let’s examine a scenario: After three years in NYC, all of your hard work pays off, and you finally land a $100,000 job in the city (go you!). After working for a couple of months, you begin to realize a six-figure salary in NYC isn’t all it is cracked up to be. You certainly don’t feel, rich.

To your surprise, a recruiter notices your career potential and calls to offer you a position in Dallas, Texas. “Crap!” you think, it’s the same income. But is it?

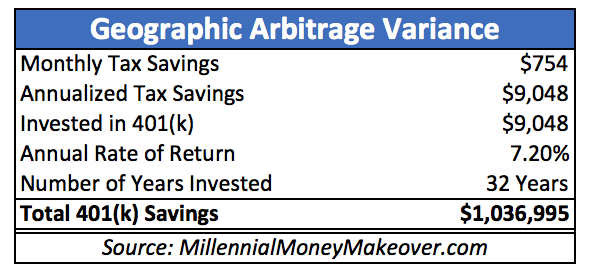

In this analysis, information from SmartAsset’s Paycheck Calculator was used to build the table below, comparing the difference between a $100,000 salary in Dallas and Manhattan.

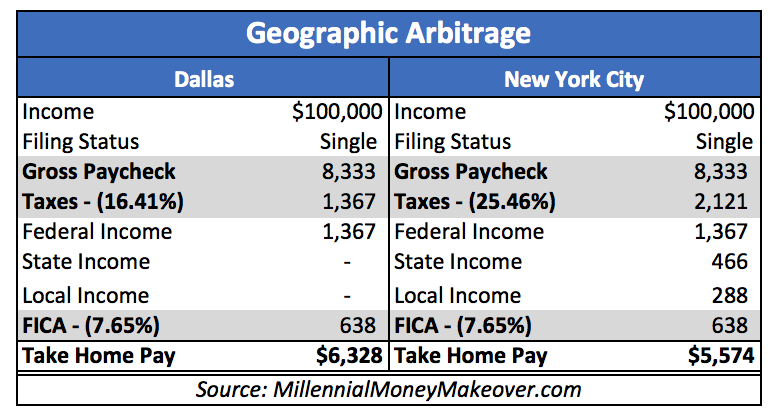

In this example, the advantage of geographic arbitrage comes in the disparity between taxes, on both a state and local basis. For the same income, a salary of $100,000, you would be able to save $9,084 a year if you lived in Dallas. If you invested those funds into your 401(k), and those funds only, over the next thirty-two years you would become a 401(k) millionaire!

Here is the kicker; this calculation is only considering taxes. When moving between two locations, there are a host of variables that make up the cost of living difference – housing, education, food, and entertainment – which will only further accelerate your path to the rich life.

Conclusion

Millennials live in metropolitan areas – New York, Seattle, Los Angeles, Houston – that have a wide range in their cost of living. If you struggle financially or want a bigger bang for your buck, consider taking advantage of geographic arbitrage. The new rich have adopted this strategy. It is simple, proven, and readily available.

Ready to pack your bags?